yieldfinity

v1.40.0

Published

A strategy backtester/runner for trading / cryptotrading

Downloads

213

Readme

Strategy backtester

A node strategy backtesting / running framework for crypto trading and more.

⚠️ This project is under active development and is not suitable for production use yet.

Summary

- Getting started

- Yieldfinity playground

- Quickstart

- Indicator trigger based strategies Premade indicator triggers for fast prototyping

- Custom methods based strategies Custom strategy triggers for advanced strategy building

- Candles Candle data from exchanges

- Indicators Indicators are calculated values based on price an other parameters you can set triggers on

- Triggers Triggers are comparison functions that will trigger an order if the condition is met (i.e. if the indicator reaches a value you defined)

- Custom triggers Build your own trigger functions

- Custom trigger flow Prepare the triggers for the strategy

- Indicator triggers Pre made triggers based on indicators

- Basic usage

- Model

- Trigger flow Prepare the triggers for the strategy

- Available triggers

- Custom triggers Build your own trigger functions

- Strategies Bundle your indicators, your triggers, and backtest a strategy

Getting started

Yieldfinity is a TS / node strategy backtesting framework, currently under active development. It fetches candle data from binance for any given pair, allows you to create strategies, feed them indicators and triggers, and backtest them. Strategies rely on one or many indicators and either indicator triggers or custom triggers to work. Indicators provide the computed candle data, and the indicator triggers are function checking if they should trigger an order or not.

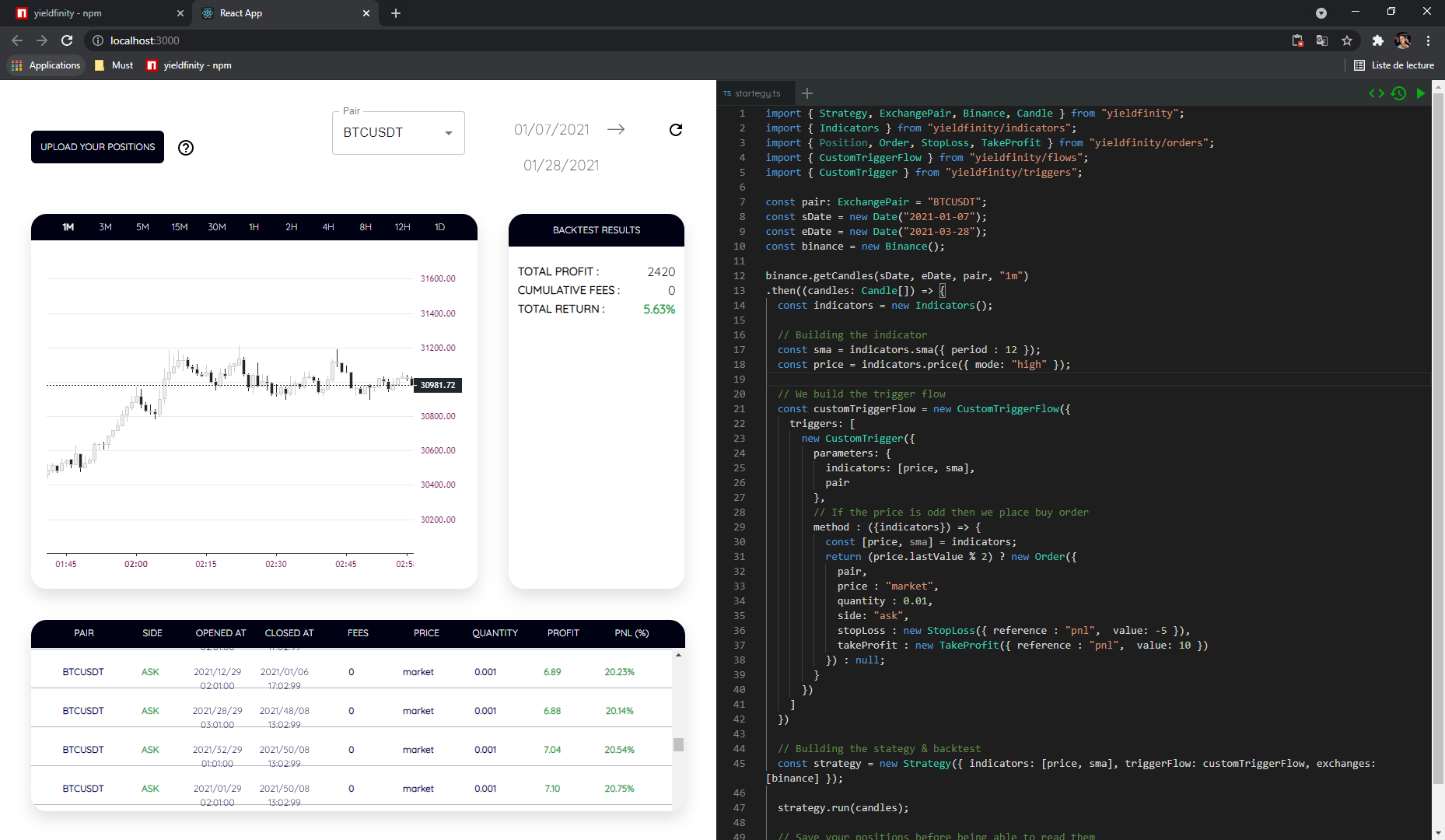

Yieldfinity playground

Checkout the yieldfinity playground : it allows you to code and visualize your strategies directly in your web browser.

Quickstart

Custom methods based strategies

This method uses a custom function which triggers either a buy or a sell order. Let's make a ridiculously stupid strategy : if the price is even, we buy, else we sell.

import { Strategy, ExchangePair, Binance, Candle } from "yieldfinity";

import { Indicators } from "yieldfinity/indicators";

import { Position, Order, StopLoss, TakeProfit } from "yieldfinity/orders";

import { CustomTriggerFlow } from "yieldfinity/flows";

import { CustomTrigger } from "yieldfinity/triggers";

const pair: ExchangePair = "BTCUSDT";

const sDate = new Date("2021-01-07");

const eDate = new Date("2021-03-28");

const binance = new Binance();

binance.getCandles(sDate, eDate, pair, "1m")

.then((candles: Candle[]) => {

const indicators = new Indicators();

// Building the indicator

const sma = indicators.sma({ period : 12 });

const price = indicators.price({ mode: "high" });

// We build the trigger flow

const customTriggerFlow = new CustomTriggerFlow({

triggers: [

new CustomTrigger({

parameters: {

indicators: [price, sma],

pair

},

// If the price is odd then we place buy order

method : ({indicators}) => {

const [price, sma] = indicators;

return (price.lastValue % 2) ? new Order({

pair,

price : "market",

quantity : 0.01,

side: "long",

stopLoss : new StopLoss({ reference : "pnl", value: -5 }),

takeProfit : new TakeProfit({ reference : "pnl", value: 10 })

}) : null;

}

})

]

})

// Building the stategy & backtest

const strategy = new Strategy({ indicators: [price, sma], triggerFlow: customTriggerFlow, exchanges: [binance] });

strategy.run(candles);

// Save your positions before being able to read them

strategy.savePositions();

const profit = strategy.profit;

const pnl = strategy.pnl;

const profitablePositions = Math.ceil(strategy.profitablePositions.length / strategy.positions.length * 100);

console.log(`Strategy made a profit of ${profit} (${pnl}%) : ${profitablePositions}% of positions were profitable`);

});

Indicator trigger based strategies

An indicator trigger is a function that will be executed automatically at each candle. It takes standardized parameters for quick prototyping.

// Imports

import { Strategy, ExchangePair, Binance, Candle } from "yieldfinity";

import { Indicators } from "yieldfinity/indicators";

import { Position, Order, StopLoss, TakeProfit } from "yieldfinity/orders";

import { TriggerFlow } from "yieldfinity/flows";

import { PriceTrigger, SMATrigger } from "yieldfinity/triggers";

const pair: ExchangePair = "BTCUSDT";

const sDate = new Date("2021-01-01");

const eDate = new Date("2021-01-30");

const binance = new Binance();

binance.getCandles(sDate, eDate, pair, "1m")

.then((candles: Candle[]) => {

const indicators = new Indicators();

// Building the indicator

const sma = indicators.sma({ period : 12 });

const price = indicators.price({ mode: "high" });

// Building the triggers

const triggers = [

new SMATrigger({ indicator: sma, field: "value", triggerValue : 2, comparer: ">=", mode: "percentage", tMinus: 60*24 }),

new PriceTrigger({ indicator: price, field: "value", triggerValue : 10, comparer: ">=", mode: "percentage", tMinus: 60 * 12 }),

];

const triggerFlow = new TriggerFlow({

flow : [{

triggers,

operator : "and",

position: new Order({

pair,

price : "market",

quantity : 1,

side: "long",

stopLoss : new StopLoss({ reference : "pnl", value: -5 }),

takeProfit : new TakeProfit({ reference : "pnl", value: 10 })

})

}]

});

// Building the stategy & backtest

const strategy = new Strategy({ indicators: [price, sma], triggerFlow, exchanges: [binance] });

strategy.run(candles);

// Save your positions before being able to read them

strategy.savePositions(candles);

console.log(`${strategy.closedPositions.filter(pos => pos.state.profit > 0).length}/${strategy.closedPositions.length} profitable positions`)

});

Candles

Model

interface Candle {

openAt: Date;

closeAt: Date;

open: number;

close: number;

high: number;

low: number;

volume: number;

exchange: string;

pair: ExchangePair;

interval: ExchangeInterval;

}You can fetch the candles from Binance as such :

import { ExchangePair, Binance } from "yieldfinity";

const pair: ExchangePair = "BTCUSDT";

const sDate = new Date("2021-01-01");

const eDate = new Date("2021-04-30");

const candles = await new Binance().getCandles(sDate, eDate, pair, "1m"); // Must be 1m for nowIndicators

Model

interface Indicator {

method(): Function;

name(): string;

values():IndicatorOutput[];

parameters(): IndicatorParameters;

lastValue() : IndicatorOutput;

lastIndex() : number;

}Your indicators can be anything, from a regular technical indicator to an external datasource. They simply are generator functions returning a value for each candle being fed to it.

Import the indicators as such :

import { Indicators } from "yieldfinity";

// or

import { Indicators } from "yieldfinity/indicators";

const indicators = new Indicators();Existing indicators

Price

const price = indicators.price({

mode: "high" // "high" | "low" | "close" | "open";

});

price.generate(candle);

console.log(price.lastValue) // 152400.2SMA

const sma = indicators.sma({

period : 12 // number;

});

sma.generate(candle);

console.log(sma.lastValue) // 254.2EMA

const ema = indicators.ema({

period : 12 // number;

});

ema.generate(candle);

console.log(ema.lastValue) // 124.5RSI

const rsi = indicators.rsi({

period : 12 // number;

});

rsi.generate(candle);

console.log(rsi.lastValue) // 748.5ATR - ⚠ not available yet

const atr = indicators.atr({

period : 12 // number;

});

atr.generate(candle);

console.log(atr.lastValue) // 748.5MACD

const macd = indicators.macd({

fastPeriod: 12, // number

slowPeriod: 24, // number

signalPeriod: 12 // number

});

macd.generate(candle);

console.log(macd.lastValue)

/*

{

MACD: 20, // number

histogram: 50, // number

signal: 10, // number

}

*/Triggers

Custom triggers

You can create your own triggering method (useful if you want to create signals, code and debug your own strategy, or if you wish to have more control over what your backtesting process) .

A custom trigger method must have the following prototype :

type CustomTriggerMethod = (parameters : any) => Position | null;Custom Trigger flow

After creating your custom trigger, you must then insert it into a CustomTriggerFlow, and pass it to a strategy as such :

import { CustomTriggerFlow } from "yieldfinity";

// or

import { CustomTriggerFlow } from "yieldfinity/flows";

// Build a custom strategy flow

const customTriggerFlow = new CustomTriggerFlow({

triggers: [

new CustomTrigger({

parameters: [price], // Indicator[]

method : ([price]) => {

// Define your own method here, return a position or null;

return null;

}

})

]

})

// Building the stategy & backtest

const strategy = new Strategy({ indicators: [price, sma], triggerFlow: customTriggerFlow });

strategy.run(candles);Indicator triggers

Basic usage

You can create strategies using triggers. Once your indicator has been generated, the trigger will compare the value of the indicator with the parameters you fed to the trigger. For each trigger, the field corresponds to either of the indicator output. For instance, values available for the MACDTrigger are MACD or histogram or signal.

Model

/**

* Indicator trigger

* @param field: the name of the output of an indicator you can set a trigger on

* @param triggerField: ❌ Not available yet

Optionnal, only for multiple output indicators. For instance, allows you to compare the MACD

signal against the histogram to check if the lines are crossing. If specified, tMinus will

be ignored and only market values will be compared.

* @param triggerValue :

If tMinus = 0, the market value of the indicator and the

triggerValue are compared, else it will take the value of the indicator at t - tMinus

and compare it using the triggerValue

* @param tMinus : in minutes

* @param comparer : basic TS comparison operators ("<" or ">" or "<=" or "=>" or "=" )

* @param mode :

If "percentage", will check the evolution of the indicator in % (tMinus must be > 0).

If "relative", the triggerValue will be added to the indicator's value.

If "absolute", the triggerValue will directly be compared to the indicator's value.

**/

interface IndicatorTrigger {

indicator: Indicator;

field: string; // See each available trigger example below for usage

triggerField ?: string;

triggerValue : number;

tMinus ?: number;

comparer : Comparer;

mode : ComparerMode;

}Trigger flow

After creating your trigger, you must then insert it into a TriggerFlow, and pass it to a strategy as such :

import { SMATrigger, PriceTrigger } from "yieldfinity/triggers";

import { TriggerFlow } from "yieldfinity/flows";

// or

import { SMATrigger, PriceTrigger, TriggerFlow } from "yieldfinity/flows";

// Building the triggers

const triggers = [

new SMATrigger({ indicator: sma, field: "value", triggerValue : 2, comparer: ">=", mode: "percentage", tMinus: 60*24 }),

new PriceTrigger({ indicator: price, field: "value", triggerValue : 10, comparer: ">=", mode: "percentage", tMinus: 60 * 12 }),

];

const triggerFlow = new TriggerFlow({

flow : [{ triggers : triggers, operator : "and", position: askOrder }]

});

// Building the stategy & backtest

const strategy = new Strategy({ indicators: [price, sma], triggerFlow: customTriggerFlow });

strategy.run(candles);Available triggers

You can set a trigger for each indicator already available :

Price

const price = indicators.price({ mode: "high" });

const priceTrigger = new PriceTrigger({ indicator: price, field: "value", triggerValue : 10, comparer: ">=", mode: "percentage", tMinus: 60 * 12 })

// Check if price raised by 10% over the last 12 hoursSMA

const sma = indicators.sma({ period: 12 });

const emaTrigger = new SMATrigger({ indicator: price, field: "value", triggerValue : 100, comparer: "<", mode: "absolute", tMinus: 0 })

// Check if SMA is marketly < 100EMA

const ema = indicators.ema({ period: 12 });

const emaTrigger = new EMATrigger({ indicator: price, field: "value", triggerValue : 200, comparer: ">=", mode: "relative", tMinus: 60 * 24 })

// Check if EMA as gained 200 points over the last 24 hoursRSI

const rsi = indicators.rsi({ period: 12 });

const rsiTrigger = new RSITrigger({ indicator: price, field: "value", triggerValue : 200, comparer: ">=", mode: "relative", tMinus: 60 * 24 })

// Check if RSI as gained 200 points over the last 24 hoursATR - ⚠ not available yet

const ATR = indicators.ATR({ period: 12 });

const ATRTrigger = new ATRTrigger({ indicator: price, field: "value", triggerValue : 200, comparer: ">=", mode: "relative", tMinus: 60 * 24 })

// Check if ATR as gained 200 points over the last 24 hoursMACD

const macd = indicators.macd({

fastPeriod: 12, // number

slowPeriod: 24, // number

signalPeriod: 12 // number

});

const macdTrigger = new MACDTrigger({

indicator: macd,

field: "histogram", // can be either "MACD" | "histogram" | "signal"

triggerValue : 2,

comparer: ">=", mode:

"percentage",

tMinus: 5

})

// Check if MACD histogram as gained 2% over the last 5 minutesStrategies

Strategies handle the indicators and the triggers for you, and are defined as such :

Model

interface Strategy {

indicators: Indicator[];

triggerFlow : TriggerFlow | CustomTriggerFlow;

}Backtest

You can feed your indicators, trigger flow or custom trigger flow and new candles to your strategy and start backtesting like this :

import { Strategy } from "yieldfinity";

// Building the stategy & backtest

const strategy = new Strategy({ indicators: [price, sma], triggerFlow: customTriggerFlow });

strategy.run(candles);